In

2015, Chinese pesticide industry experienced a downturn. Only chlorothalonil performed well: price growth and outstanding exports. It is estimated that the

market demand for chlorothalonil will still maintain stable in the future.

In

2015, the Chinese pesticide industry was sluggish. In general, pesticide prices

remained at low level and only a few products prices grew against sluggish

pesticide market. Among them, chlorothalonil is a key example, its price went

up and the exports performed well. Therefore, it is anticipated that the demand

for chlorothalonil will still maintain stable in the future.

Chinese

chlorothalonil price rose against sluggish pesticide market in 2015

In

Q1-Q3, increasing foreign orders and low chlorothalonil inventory made

chlorothalonil supply tight. According to market research, the domestic

chlorothalonil manufacturers were Limin Chemical Co., Ltd. (Limin Chemical),

CAC Group Co., Ltd. (CAC), Jiangyin Suli Fine Chemical Co., Ltd. (Jiangyin

Suli), Jiangsu Weunite Fine Chemical Co., Ltd. (Jiangsu Weunite) and Jiangsu

Xinhe Agrochemical Co., Ltd. (Xinhe Agrochemical). have been fully engaged in

orders.

As

chlorothalonil is not bulk pesticide product, the majority of manufacturers

don't stock goods in large quantity. Therefore, when the demand for

chlorothalonil exceeds manufacturers’ prediction, their inventory drops

rapidly, which makes chlorothalonil in short supply.

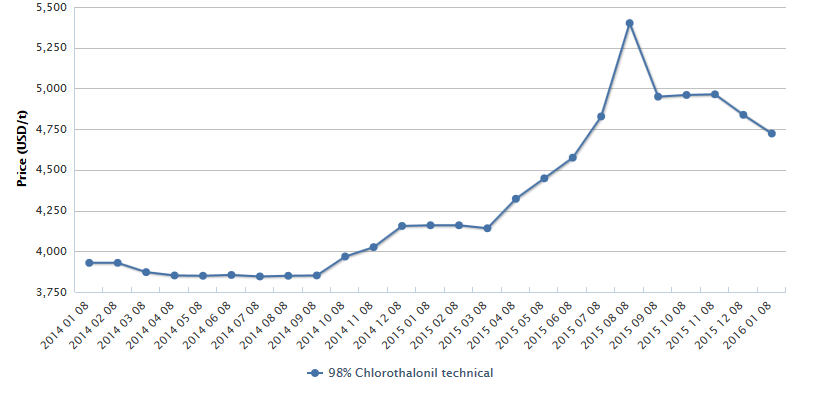

These

factors contributed to an upward trend in domestic chlorothalonil price,

especially since Q2. Obviously, Chinese chlorothalonil price hit the highest

point in Aug. According to CCM's price monitoring, the average ex-works price

of 98% chlorothalonil TC was USD5,410/t in Aug., a MoM rise of 11.87% and a YoY

rise of 40.29%. Besides, its price rose by 29.83% compared with that in Jan.

This statistics were the largest increase in the past two years.

In

Q4, chlorothalonil price dropped compared with the previous three quarters as

market demand weakened and supply tension relieved, but overall, it still

maintained high level compared with the same period of 2014.

According

to market investigation, at present, major manufacturers stated that they have

no chlorothalonil TC inventory, but they still operate normally and orders have

been fully booked.

Among

them, Jiangyin Suli’s chlorothalonil production facility is working normally

(capacity:14,000 t/a) and it has no inventory.

Limin

Chemical has no inventory and its orders have been fully booked. CAC operates

normally with daily output of more than 1 tonne.

It

is estimated that the tight supply of chlorothalonil market won’t be eased and

its price will still maintain high in a short term.

Monthly

ex-works price of 98% chlorothalonil technical in China, Jan. 2014-Jan. 2016

Source:

CCM

China's exports of

chlorothalonil showed good momentum In 2015

Owing

to the decreasing chlorothalonil supply from foreign suppliers, most of the

foreign clients turned to imports, which contributes to an increase in

chlorothalonil orders of domestic manufacturers and therefore propels China's

exports of chlorothalonil.

Zhang

Wenjun, Director of International Cooperation Service of the Institute for the

Control of Agrochemicals, Ministry of Agriculture (ICAMA), revealed that from

Jan. to Sept., half of the exported products perform unsatisfactorily. Among

the 407 exported products, 205 products dropped obviously.

Over

half of the top-20 exported products (by value) severely dropped. By contrast,

chlorothalonil witnessed huge increases in both export volume and values in

2015.

From

Q1 to Q3, the export volume of chlorothalonil was around 17,900 tonnes with a

YoY growth of 10.90%, ranking the 8th among Chinese exported pesticides (by

volume), taking up 1.51% of the national total exports. Chlorothalonil became

the top-1 fungicide variety by export volume. In 2014, chlorothalonil ranked

the 12th among Chinese exported pesticides (by volume).

From

Q1 to Q3, the export value of chlorothalonil rose by 16.28% to USD72 million,

ranking the 14th (by value) and accounting for 1.26% of Chinese total export

values. In 2014, chlorothalonil ranked the17th, only second to that of

tebuconazole.

Market demand for

chlorothalonil remains stable in the future

In

2016, the demand for chlorothalonil will remain stable. According to data from

the National Agro-Tech Extension and Service Center, the demand for fungicide is expected to decline in 2016, maintaining at 82,700 tonnes, decreasing by

9.25% year on year. Copper sulfate, carbendazim, ethylenebisdithiocarbomates

(EBDCs) fungicides, thiophanate-methyl, tricyclazole, chlorothalonil,

triadimefon, jingangmycin, isoprothiolane and copper hydroxide are strongly

demanded.

Therefore,

it is foreseeable that the market presence of chlorothalonil is relatively

stable in the future.

This article comes from Fungicides China News 1601, CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: pesticide chlorothalonil fungicide